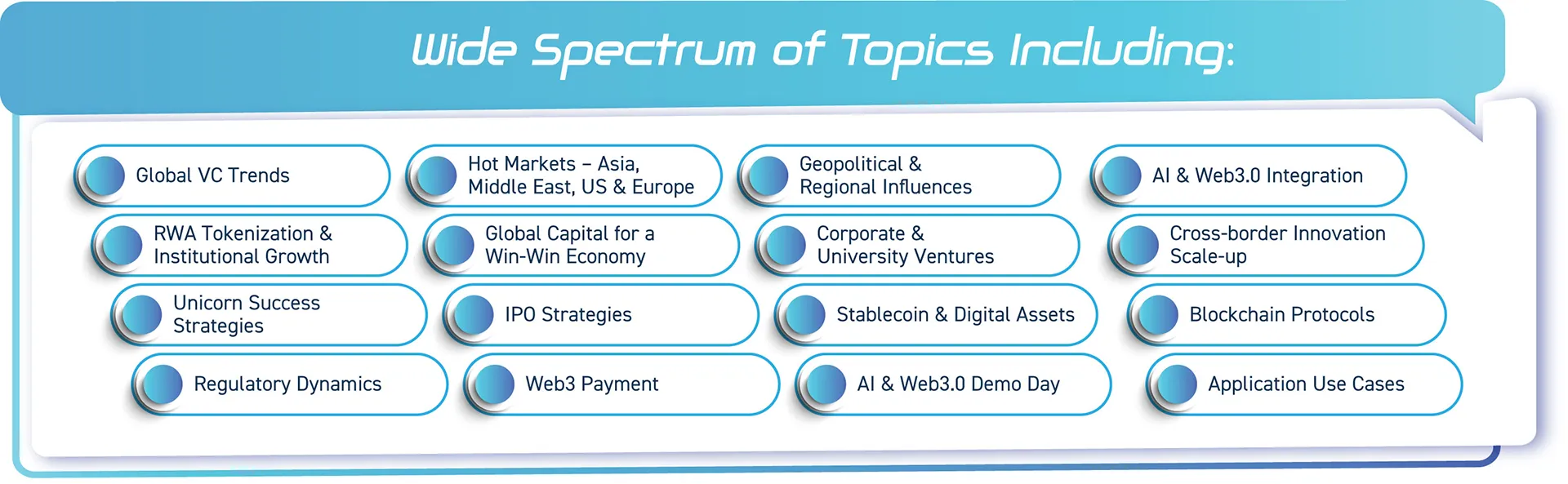

Cyberport Venture Capital Forum 2025 (CVCF) is the premier event where visionary innovators meet strategic investors to ignite growth amid the rise of AI, digital assets, and shifting venture landscapes.

Discover emerging market dynamics, explore inspiring journeys of innovators turning bold ideas into impactful ventures, and connect with industry leaders shaping the future.

Join CVCF 2025 to unlock fresh insights and bold pathways in tech innovation and investment.

Cyberport Investors Network (CIN) is a structured platform that engages global investors who have interest to invest in Cyberport community companies. CIN aims to offer companies of different tech sectors and fundraising lifecycles a diversified investor base and funding aptitudes to foster investment into Cyberport’s promising start-ups. CIN comprises venture capital, private equity funds, corporate investors, angel investors, family offices and more.

CIN member benefits:

Web3.0 Investors Circle (W3IC) operates under the umbrella of the Cyberport Investors Network (CIN) and aims to create an exclusive network for investors interested in the Web3.0 domain, facilitating investments in Web3.0 -related investment and funding opportunities. By joining W3IC, investors gain access to project showcases, exclusive closed-door Web3 investor events, networking forums, deal-sharing sessions and more.

Investors interested in joining the Cyberport Investors Network (CIN), please contact us at investor@cyberport.hk