Venture in Focus

Cyberport Venture Capital Forum (CVCF), the region’s global tech venture event, presents “Venture in Focus” with the latest industry insights and fresh perspectives on smart investments & digital transformation for you to pivot in the new normal. Stay with us for more insider viewpoints to come!

Asia Venture Capital Forum 2021

Asia Venture Capital Forum (AVCF) 2021, jointly organised by the Hong Kong Venture Capital and Private Equity Association with Hong Kong Cyberport and Hong Kong Science and Technology Parks, was the second year in a row the event held in virtual format! The half-day event featured a four-hour long program covering venture investment topics such as foodtech, regtech, SPACs and telemedicine. Limited partners and single family offices shared their views on recent opportunities and challenges. Asian unicorns and corporate ventures discussed success metrics and experiences, among other issues, and there was a focus on the most recent regulatory updates, especially around ESG.

Moderated by Cyberport’s Chief Public Mission Officer, Eric Chan, “The Journey of Asia’s Unicorns” panel discussion at AVCF 2021 featured Asia’s start-ups to share their successful journey to become unicorns, the challenges and obstacles under the pandemic situation and the insights of their business development. Here are the highlights:

Chief Public Mission Officer, Cyberport:

“It is not easy to take the company to the unicorn, and the team has gone through a lot of challenges and overcome many obstacles along the way. Many start-ups would like to know what the key success factors or qualities that a start-up must have so that it becomes attractive to investors.”

Robby Yung, CEO, Animoca Brands (Cyberport’s 5th unicorn):

“I would say persistence and adoptability are key to attract investors. You must be tenacious about addressing the market and willing to change and adapt as the market evolves. It took a lot of courage for us to move the ship to an area uncharted… and turned out to be the right decision. So I think you have to be feasible and willing to change, especially when you are in technology because it’s always changing.

Valuation is not that important because it will happen over time. I think it’s far more important of who is investing, how much and at what price. If somebody is offering you money, take it! Things go in circles all the time and people offer you money when you don’t need it, and they will not want to take your call when you do need it. I would recommend taking the money when someone is offering you.

”

William Li, CEO & Co-Founder, Akulaku:

“You need to have a very strong mindset to keep going on because there are lots of challenges especially during the new normal. You must be determined when investing in the technology because that is the only way that can penetrate in this market.

Pandemic really changes lots of things. Sometimes you need to replan the business. If you think this is not the right way to go along with then just change your plan and change the journey, that is nothing to be ashamed of. ”

Russell Cummer, Founder & Executive Chairman, Paidy:

“Capital - be a human capital or financial capital, is just kind of input that you can use to create what you want to create in your business and your vision, but it doesn’t obviate the need to just get down to business and doing it.

The key to fundraise amidst an economic downturn is to concentrate on improving your business and make sure your business is operating well, and then fundraising will follow. If your business is good at solving a valuable problem in the market, as well as scaling up and de-risking, then they should already address your ability to fundraise. ”

CVCF WEBINAR SERIES 2020: DO GOOD AND DO WELL WITH EDTECH VENTURES

As a sequel to the Cyberport Venture Capital Forum (CVCF), Cyberport again joined hands with Esperanza to organize the “Do Good and Do Well with EdTech Ventures” webinar. The webinar featured 20+ global experts and investors who delved into the EdTech dynamics and attracted close to 300 audiences. Ryan Tang, age 8, was put in charge as the emcee of the webinar: “As an ultimate end user of education technology, I am really counting on you guys to create something that can help us learn effectively in an interesting and most important of all – a fun way.”

Opening Dialogue

EdVentures Global Business Acceleration Summit was a spotlight event of Cyberport Venture Capital Forum (CVCF) 2020 to explore deeper development of the edtech sector. The Edventures GBA Fellowship has well illustrated the strength of Hong Kong in playing the role of facilitating international investment for developing edtech in GBA and the region. Esperanza and Cyberport would continue working together to catalyse education innovation in Hong Kong in a series of edtech and STEM related events targeting funders, knowledge partners, event partners, mentors, and volunteers, to bring the ideas into fruition.

Breakout - Science of Learning

Science of learning studies the principles behind superior learning performance, from engagement, motivation, behavioural change to learning. This panel looks into the application of Science of Learning through the two case studies of PolyUp and Minerva.

Breakout - Business Model and Investment Considerations for EdTech Ventures

Edtech drives positive impact to society and can catalyse the access and delivery of education on a bigger scale especially with live streaming and AI. Investment in technology can empower the education system to address the problems of 21st century learning.

Breakout - Measuring Learning Outcome and Social Return On Investment

This panel looks into impact measurement from both the investor and educator sides, under the UN Sustainable Development Goals framework of making education more equitable, inclusive and sustainable.

Breakout - How could family offices and NGO get involved with edtech ventures?

Edtech space is largely unexplored in the impact investment arena, but visionaries have begun to look into the opportunities, given its potential of delivering market rate returns and at the same time transforming an antiquated education system.

Panel - Presentations from Winners of Edventures GBA Fellowship

The Edventures GBA Fellowship is a Global Business Acceleration programme for education technology ventures. It also provides an opportunity for the Fellows to understand the market and business opportunities of the Greater Bay Area (GBA), Asia's Silicon Valley. The presentation from the three winning start-ups illustrates the value of Hong Kong as an open and international city with people passionate to drive changes in education.

Panel - Cross-Sector and Cross-Border Partnerships

Enormous opportunities lie in the edtech space especially in the wake of the pandemic, as there will be major developments in AI, big data and personalized learning. Edtech start-ups are poised to partner with institutional investors, corporate investors, education institutes and technology service providers across different countries.

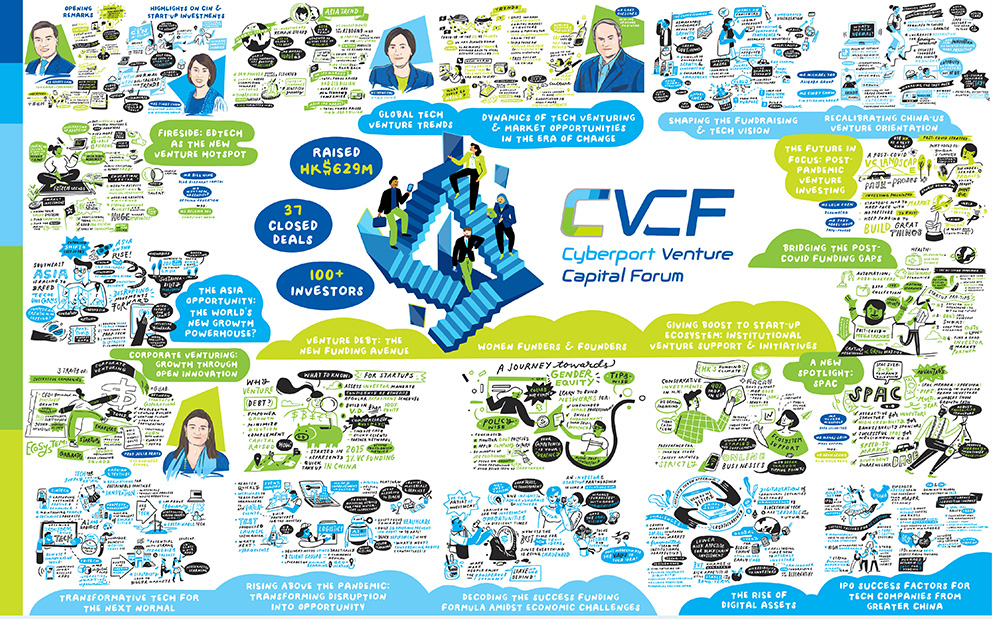

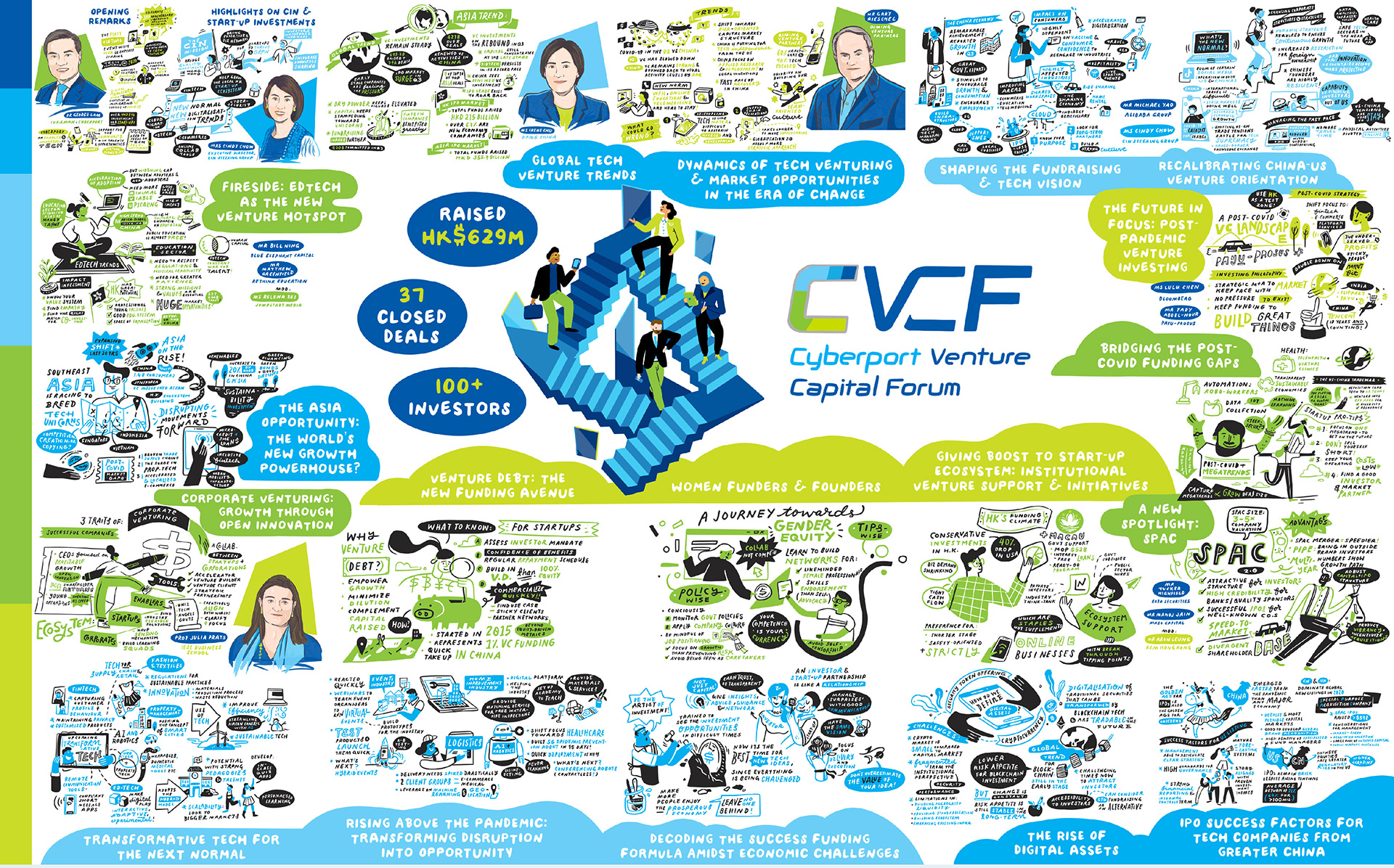

CVCF 2020 Key Takeaways

CVCF2020 Webinar Series: EdTech Investment: What, Why & How

Make Money and Make Impact

"Education is the most powerful weapon we can use to change the world," said Nelson

Mandela. Are you ready to invest in EdTech that will make this weapon even more

powerful? COVID-19 has accelerated the digital revolution in the education sector in a

matter of weeks. The global EdTech market is full of investment opportunities for people

and organisations that seek to make money and impact. You will learn from experts in and

outside Hong Kong on the market and growth opportunities for EdTech, the investment

considerations and how you can make the first move if you are a novice.

John Tsang, Esperanza:

“COVID-19 had accelerated the digital transformation of the education system. Successful implementation of the e-learning experiment would require effective collaboration among a complex network of players outside the classroom, from policy-makers and educators to EdTech providers and funders.”

Andy Ann, Golmpact Capital Partners:

“For decades or generations our education system has remained unchanged and myself as a student as an educator and as a teacher have kept using the same old tools all these years and until recently has fast-tracked the entire EdTech industry and evolving drastically in the education technology.”

Atin Batra, Twenty Seven Ventures:

“EdTech had moved from sheer sharing of learning materials online, e-tutoring to community learning nowadays… it is important to set impact/purpose driven mindset for both the start-up founder and investors in EdTech businesses.”

Joseph Fung, Saltagen Ventures:

“We believed that education could make the largest impact on society. We saw the value of technology in enabling personalized learning. The pandemic had certainly accelerated schools’ digital adoption, with significant increases in investment in both infrastructure and professional development of teachers.”

Josh Zhou, LEGO Ventures

“Hong Kong had a strong talent pool and the advantage of having a British education system that made it easier to transfer knowledge and applications to other markets. Hong Kong also possessed strong academic research capability with international scholars and researchers.”

Jennifer Poh, Sustainable Finance Initiative:

“This year has been called the year of EdTech, being the most funded sector, over 11 billion dollars was invested into EdTech globally just in the first half of 2020; 26 companies received more than 100 million dollars in funding and over 400 companies received over one million dollars in investments. Investors are able to understand EdTech better and to relate concretely to the opportunities and its applicability under this spectrum with COVID.”

Tytus Michalski, Fresco Capital:

“Investing in EdTech would take a longer time horizon as building scale took time, albeit the pandemic would possibly accelerate the growth. It is important to invest with a vision.”

Yat Siu, Outblaze:

“The pandemic made it opportune to look into new models of EdTech that were not attached to the past mode of learning. Personalized learning and user-generated contents are interesting fields to explore.”

Please click the thumbnail for the webinar playback.

CVCF Webinar Series: Virtual Platform as the New Normal of Fundraising & Digital Asset Investment

Are you approaching an impasse for fundraising and investment during the pandemic? Virtual platforms are now in hot demand to mitigate deal sourcing challenges and broaden investment opportunities amidst in the new normal. Digital asset tokenisation and trading also open up innovative and cost-effective higher liquidity channels for investors and companies.

Eric Chan, Chief Public Mission Officer, Cyberport:

“We’re trying to look at how this tech venturing is heading amidst the COVID-19 and the trade tension, how has COVID impacted the market development and funding outlook for technology in Southeast Asia and Hong Kong start-up ecosystem?”

Karena Belin, Co-Founder, COO & CFO, AngelHub:

“We can clearly see a polarization in terms of east and west which shows a lot of opportunities because investors also understand it's not enough to only look into one market but you probably need to diversify your portfolio regionally and geographically. ”

Johnson Chen, Founder & CEO, Capbridge:

“The COVID pandemic has definitely increased the digitalization speed… all these additional fundraising tools would be probably the new norm, another trend is cross-border working together because the markets are no longer on its own and we need to partner up to enhance the ecosystem.”

Eric Chan, Chief Public Mission Officer, Cyberport:

“We’ve heard a lot of promises about new trends of assets and the promises of blockchain technology, how asset tokenisation is going and what blockchain is going to bring the new generation?”

Adrian Lai, CEO, Liquefy:

“If I want to sell my US fund today and buy an Asian fund, I need 4 days because there's settlement time. Tokenization applies here, I could run both funds registrar on the blockchain and do instant transfer and settlement, liquidity comes in with tokenization as a technology to allow instant transfer between 2 funds for an individual, I think that's the future.”

Dr. Shibin Wang, Co-founder and Chief Business Officer:

“Blockchain is now a standalone technology, in the future the technology must be combined with other technology like cloud computing and artificial intelligence to support the market, and to lower the threshold of Blockchain and security token technology for every company no matter of their size.”

Please click the thumbnail for the webinar playback.

CVCF2020 Webinar Series: Capturing EdTech Opportunities in Greater Bay Area

EdVentures Global Business Acceleration Fellowship, a spotlight of this year’s Cyberport Venture Capital Forum (CVCF) staged a webinar for ventures interested in EdTech opportunities in the Greater Bay Area.

In a panel moderated by Cyberport’s Chief Public Mission Officer Eric Chan, leaders from enterprise, investment, legal and consultancy fields shared great insights on EdTech’s industry environment, market entry, policy, funding and global marketing platform in the Greater Bay Area. Here are the highlights:

John Tsang, Founder, Esperanza:

“We believe that we can learn from and collaborate with one another in developing effective solutions with global significance.”

Eric Chan, Chief Public Mission Officer, Cyberport:

“Many overseas companies see Hong Kong as the perfect place to land in Asia, using Hong Kong as launch pad for the China GBA region as well as the neighbouring countries in southeast Asia.”

Laura Shi, Executive Director, Investment of Greater Bay Area Development Fund Management Limited:

“It has been proved as a great strategy to have companies based in the greater bay area and to develop the Chinese market and that’s always a right move to start from Hong Kong.”

Catherine Tsang, Partner – Tax & China Business Advisory Services, PwC Hong Kong:

“Infrastructures and funding programmes supported by the government will unleash economic development in GBA area and create business opportunities for both young entrepreneurs and corporations who are looking to do business in the region. “

Ming Kwok, CEO & Founder, Trumptech Group:

“Hong Kong is a very good test bed for the EdTech industry to make sure you are in the right track developing the right product.”

Joe Lam, Managing Director, Pearson Greater China and India Hub:

“Capital and hardware manufacturers are the key benefits of GBA; innovative of the business model and the pay model are key success factor for doing business in China.”

Eunice Chiu, Partner, Disputes Resolution Group, Oldham, Li & Nie:

“Hong Kong as a city can be a good gateway into the GBA area and providing lots of legal resources.”

Please click the thumbnail for the webinar playback.

Asia Venture Capital Forum

With the support of all participating members, ‘Asia Venture Capital Forum 2020’ (AVCF 2020), jointly organised by the Hong Kong Venture Capital and Private Equity Association with Hong Kong Cyberport and Hong Kong Science and Technology Parks, was concluded with great success! Opened to investors and entrepreneurs from around the world, the seventh edition of the Forum covered a range of topics including corporate venture capital, PropTech, logistics, international economic landscape and several panels differentiated by investor niche and geographies.

Mr Eric Chan, Chief Public Mission Officer of Cyberport, moderated the ‘Investment Outlook’ panel session during the forum. He first briefly introduced Cyberport as a one-stop platform for funding, mentorship and networks for start-ups, and outlined ‘Cyberport Investors Network’ and ‘Cyberport Macro Fund’ as our two key initiatives in terms of venture capital. Here are the highlights:

Eric Chan, Chief Public Mission Officer, Cyberport:

“Cyberport provides one-stop platform for funding, mentorship and networks to help start-ups succeed. Cyberport Investors Network raised more than 361 million dollars and successfully matched 26 partnerships since its inception in 2017.”

Cindy Chow, Executive Director, Alibaba Hong Kong Entrepreneurs Fund; Chairperson, Cyberport Investors Network (CIN) Steering Group:

“Start-ups should re-evaluate their profit metrics now. Teams are recommended to build a strong company culture and spirit for teamwork and lay a strong foundation during the crisis so they can come out even stronger.”

Duncan Chiu, Co-Founder & Managing Director, Radiant Tech Ventures:

“Sharp drop in early stage investment is projected and start-ups working on POC should focus on near-term revenue and may need to avoid long-term R&D now. Logistics and HealthTech start-ups are getting a once-in-a-lifetime opportunity.”

Ben Cheng, Managing Director, C Ventures:

“Portfolio companies are advised to preserve cash and prepare for recession. Start-ups should achieve profitability in the shortest amount of time now. COVID-19 is a catalyst to boost the online shift where 5G and AI will form the eCommerce and social media backbone. ”

Please click the thumbnail for the webinar playback.